Economic activity in the Lao PDR has been weighed down by structural challenges, macroeconomic instability, and a deteriorating external environment. GDP growth was estimated at 2.7 percent for 2022, supported by a gradual recovery in tourism and other services. While the Laos-China railway and new dry port have facilitated travel and trade flows, with industrial activity supported by natural resource exports, recovery has been undermined by macroeconomic instability and external factors. The need to service large external debts, together with high import prices and limited foreign exchange, contributed to a sharp fall in the value of the kip. This caused high inflation, in turn weakening income, consumption, and investment. For many households, real income is falling and spending on health and education is declining.

��&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����; Driven by persistent external imbalances, the kip depreciated sharply in 2022 and fell by 32 and 43 percent against the Thai baht and US dollar respectively in the year to April 2023. The exchange rate has recently stabilized, supported by tighter monetary policy. However, limited exchange liquidity and low reserves have resulted in foreign exchange rationing by commercial banks, driving the parallel exchange market.

��&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����; The depreciation of the kip and rising global prices have resulted in high inflation, which stood at 40 percent in the year to April 2023. Increased global commodity prices, particularly for fuel and fertilizer, have led to rising costs for raw materials and locally produced goods. Food price inflation reached 52 percent year-on-year, severely affecting urban poor households.

��&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����; Real household incomes have suffered from rampant inflation. While the share of households reporting income losses fell from May to December 2022, nearly two-thirds of workers saw their income stagnate or decline amid rising living costs. By the end of 2022, 64 percent of Lao families were living on the same or a lower budget than a year earlier.

��&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����; Fiscal consolidation was driven by tighter expenditure and marginally higher domestic revenues. The fiscal deficit dropped slightly and the primary balance, excluding interest payments, showed a small surplus. However, revenue was still lower than before the pandemic and gross financing needs remain considerable, owing to high debt-service obligations. The lack of fiscal space is limiting the government��s ability to support poor households or to invest in health and education.

��&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����; Public and publicly guaranteed debt has reached critical levels, undermining macroeconomic stability and development prospects. Laos faces both solvency and liquidity challenges, with debt estimated at over 110 percent of GDP in 2022. The energy sector accounted for about 37 percent of debt stock in 2021. China holds about half of the external public debt stock and the repayments scheduled for 2023�C26. As the ratio of debt service payments to domestic revenue increased from 35 to 61 percent between 2017 and 2022, public spending on education and health declined from 4.2 percent of GDP to an estimated 2.6 percent in the same period.

��&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����; External imbalances remain high amid foreign currency demand for imports and debt service. As a ratio to GDP, the current account balance slightly worsened in 2022 due to a lower trade surplus and increased net income payments. Export growth was partly offset by higher import prices, particularly for fuel. Capital inflows remained limited as foreign investment declined. With only a third of export receipts entering the domestic banking sector, foreign exchange levels are inadequate.

��&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����; The economy is projected to grow at 3.9 percent in 2023 and accelerate to an average of 4.3 percent in the medium term, led by continued recovery in services and exports. External demand is expected to help sustain manufacturing and agriculture exports, while industry will benefit from investment in the power sector and special economic zones. However, growth is expected to remain below pre-COVID levels, weighed down by structural weaknesses. Inflation will remain elevated in 2023, partly due to high commodity prices and kip depreciation. If structural imbalances are addressed, the economy could recover faster.

��&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����; Household nominal incomes are expected to gradually improve, albeit undermined by high living costs. Inflation has eroded purchasing power, increased consumption costs, and depleted household savings and human capital spending, placing many households at risk of falling into poverty. Assuming Laos remains on this path of vulnerable recovery, per capita income growth will stay below pre-pandemic and regional peer levels in the medium term.

��&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����;&�Բ�����; The economic outlook is subject to significant downside risks. External risks include low growth and demand in regional economies. On the other hand, inflation in advanced economies could cause further interest rate increases and renew pressure on the kip. Domestic risks include problems in refinancing external debt, slow progress on structural reforms, and deteriorating bank balance sheets. Labor shortages due to out-migration for better wages could also undermine recovery prospects in agriculture, manufacturing, and services.

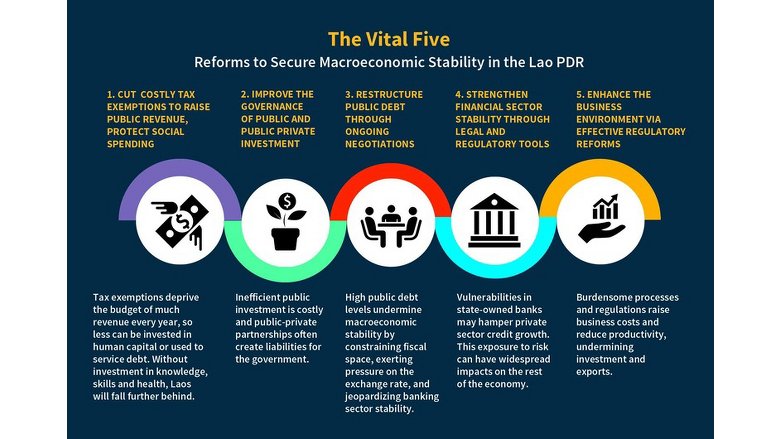

To restore macroeconomic stability, reforms are needed in five crucial policy areas:

- raising public revenues to protect spending on education, health, and social protection;

- improving expenditure allocation and efficiency;

- expediting debt negotiations;

- strengthening financial sector stability; and

- improving the business environment to promote investment and exports.

In addition, improving data availability, timeliness, and quality is key to effective evidence-based policymaking.