Photo: Workers of a Philippines materials recovery facility sort through plastic waste and segregate them for proper recycling / Shutterstock

In the Philippines, the plastics industry is not only vital to the national economy (contributing US$2.3 billion in 2018), but plastics also provide low-cost consumer goods to poor and middle-income families. However, a high dependence on single-use plastics like multilayer sachets and pouches has led the Philippines to become a ¡°sachet economy¡± that continues to worsen the alarming levels of marine plastic pollution in the region. By some estimates, the Philippines consumes a staggering 163 million pieces of sachets every day.

Like many rapidly developing countries, the Philippines grapples with unsustainable plastic production/consumption and insufficient solid waste management infrastructure. A staggering 2.7 million tons of plastic waste are generated in the Philippines each year, and an estimated 20 percent ends up in the ocean. Comprised of more than 7,500 islands, the livelihoods of the Philippines¡¯ coastal communities, and the fishing, shipping and tourism industries are especially vulnerable to the impacts of marine debris.

Understanding the urgent need to address the growth of the plastics industry and mismanagement of plastic waste, the Philippines is developing and transitioning toward a circular economy. This study uses a plastic value chain approach to evaluate the Philippines¡¯ plastics recycling industry and its role in supporting a circular economy. It identifies major challenges, market drivers and opportunities for scaling-up recycling efforts via targeted public and private sector interventions.

78% of the material value of the key plastic resins¨C upwards of US$890 million per year ¨C is lost in the Philippines when recyclable plastic products are discarded rather than recycled into valuable materials.

The Philippines had a large recycling capacity gap of 85% in 2019 (compared to Malaysia and Thailand across all four resins) and is a net exporter of plastic scrap.

Several structural challenges cause a market failure for plastics recycling:

- High logistics costs limit recyclers from sourcing feedstock across the archipelago.

- High electricity costs (38-67% higher than regional counterparts) especially burden recyclers that operate with low-efficiency equipment.

- Intense competition from the informal recycling industry distorts the market for formal recyclers.

- Significant material value is locked in low-value and hard-to-recycle flexible packaging, which represents more than half of the plastics packaging used.

- Low landfill tipping fees disincentivize local governments from investing in waste management solutions.

- The small and medium enterprises (SMEs) that dominate the domestic recycling market are unable to meet multinational buyers¡¯ requirements.

Other factors that exacerbate the market failure for plastics recycling include:

- Fluctuations in virgin resin and oil prices

- Lack of local recycled content requirements for key plastic resins

- Challenging short- and long-term collection economics for the informal sector

- Lack of ¡°design for recycling¡± standards

- Fragmented implementation of waste management

- Lack of organic waste treatment facilities

Many of these challenges are amplified by the ongoing COVID-19 pandemic. Changes in consumption patterns and low waste collection rates have led to supply reductions in the recycling industry, while low oil prices have made it cheaper to use virgin rather than recycled plastic.

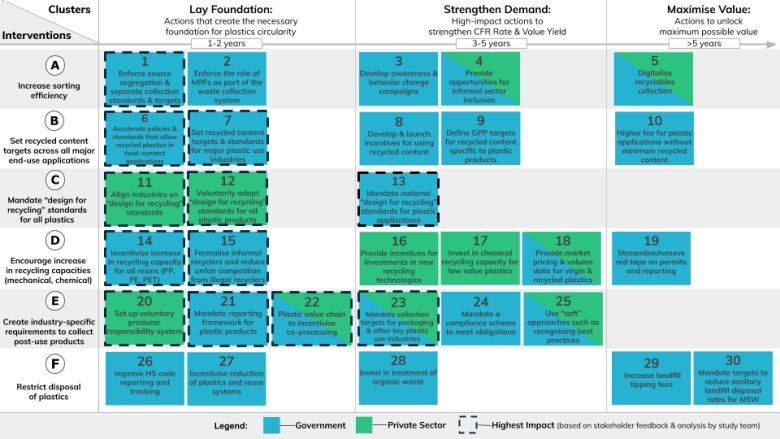

RECOMMENDED INTERVENTIONS AND ACTIONS