The COVID-19 pandemic has spread with alarming speed, infecting millions and bringing economic activity to a near-standstill as countries imposed tight restrictions on movement to halt the spread of the virus. As the health and human toll grows, the economic damage is already evident and represents the largest economic shock the world has experienced in decades.

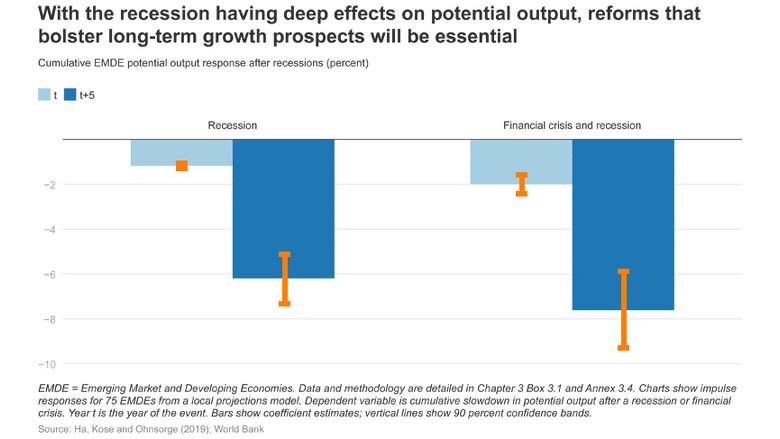

The June 2020 Global Economic Prospects describes both the immediate and near-term outlook for the impact of the pandemic and the long-term damage it has dealt to prospects for growth. The baseline forecast envisions a 5.2 percent contraction in global GDP in 2020, using market exchange rate weights��the deepest global recession in decades, despite the extraordinary efforts of governments to counter the downturn with fiscal and monetary policy support. Over the longer horizon, the deep recessions triggered by the pandemic are expected to leave lasting scars through lower investment, an erosion of human capital through lost work and schooling, and fragmentation of global trade and supply linkages.

The crisis highlights the need for urgent action to cushion the pandemic��s health and economic consequences, protect vulnerable populations, and set the stage for a lasting recovery. For emerging market and developing countries, many of which face daunting vulnerabilities, it is critical to strengthen public health systems, address the challenges posed by informality, and implement reforms that will support strong and sustainable growth once the health crisis abates.

Historic contraction of per capita income

The pandemic is expected to plunge most countries into recession in 2020, with per capita income contracting in the largest fraction of countries globally since 1870. Advanced economies are projected to shrink 7 percent. That weakness will spill over to the outlook for emerging market and developing economies, who are forecast to contract by 2.5 percent as they cope with their own domestic outbreaks of the virus. This would represent the weakest showing by this group of economies in at least sixty years.