On September 29, 2020, Egypt became the first country in the Middle East and North Africa to issue a sovereign green bond. Slightly more than a year later, with the publishing of its , EgyptĄŊs example is inspiring other countries in the regionĄŠand emerging markets more broadlyĄŠto consider green bonds as a financial solution.

The five-year green bond was initially announced for US$500 million, with an interest rate of 5.75 percent. The bond was more than seven times oversubscribed, which led the government to increase its size to US$750 million and to lower the interest rate to 5.25 percent (lower than EgyptĄŊs benchmark conventional bonds). Moreover, the bond witnessed the participation of an unprecedented 16 new investors in bond issuances denominated in US dollars.

To prepare the impact report, EgyptĄŊs Ministry of Finance received help from the Government Debt and Risk Management (GDRM) Program, a World Bank initiative sponsored by the . GDRM has been supporting Egypt since 2015 as part of a broader partnership on public debt and risk management.

Choosing a green bond over other funding options

The green bond was conceived as a financial solution to meet Egypt's pressing need for environmentally sustainable investment. Proceeds were earmarked for financing clean transportation, renewable energy, pollution prevention and control, sustainable water and wastewater management, energy efficiency, and climate change adaptation. aims to increase the proportion of green projects in the governmentĄŊs investment budget from 14 percent in 2020 to 30 percent in 2022.

To support this ambitious agenda, the Ministry of Finance started exploring financing optionsĄŠamong them green bondsĄŠwhich target investors interested in achieving both a financial and social return.

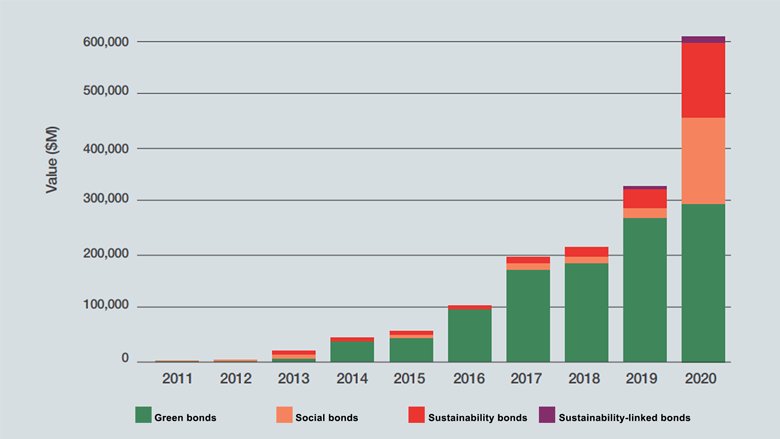

Green, social, sustainability and sustainability linked (GSSS) bonds accounted for only 2.2 percent of the US in global bond issuances in 2020. But they have been on an amid rising investor interest in supporting climate action.