Explore the report:

Reviving Growth: East Asia and Pacific Economic Update, April 2023

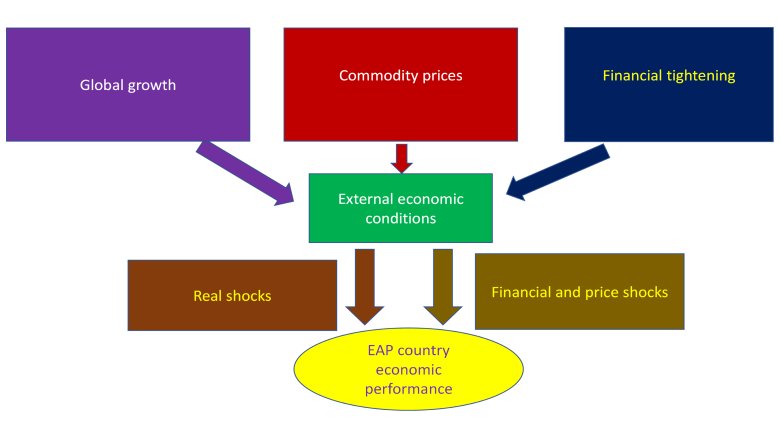

Most developing East Asia and Pacific (EAP) economies have bounced back from recent shocks and are growing. However, slowing global growth, elevated commodity prices and tightening financial conditions will affect economies in the region in 2023. In addition, EAP economies face the major challenges of de-globalization, aging, and climate change. More than two decades after the Asian Financial Crisis, the April 2023 issue of the report takes a long-term view of growth trends and needed policy actions.

Growth in developing East Asia and the Pacific (EAP) is forecast to accelerate in 2023 as China's economy reopens, while the pace of growth in most of the economies in the rest of the region is expected to ease after a strong rebound last year. Inflation remains elevated in some EAP economies, but lower than earlier peaks.

Read this section of the report:

|

Near term growth will depend on: global growth, projected to be slower in 2023 than in 2022, though recent projections are more optimistic; commodity prices, which have moderated; and financial developments, including financial tightening.

Read this section of the report:

|

Since the Asian Financial Crisis (AFC), growth in the economies of the region has been faster and more stable than in much of the rest of the world. But sounds macroeconomic management after the AFC was accompanied only to a limited extend by productivity-boosting structural reforms. Convergence with high-income countries has recently stalled.

Read this section of the report:

|

Now the region must face up to the major challenges of de-globalization, aging and climate change, to which it is particularly susceptible because it has thrived through trade, is growing old fast, and is both a victim of and contributor to climate change.

Read this section of the report:

|

Box 1. Country specific impacts of global shocks

|

Box 2. China��s economic policy trade-offs

|

Box 3. Economic prospects in Pacific Islands

|

Box 4. Idiosyncratic risks in the financial sector

|

Box 5. Productive reallocation in EAP

|

Box 6. Correlates of structural reforms and per-capita income growth: Some circumstantial evidence

|

Box 7. Structural change

|

Box 8. Why are projected economic damages from climate change increasing so rapidly?

|

Box 9. What is climate adaptation?

|

Box 10. The triple dividends approach

|

Policy Issues examined in recent economic updates

Previous updates have focused on a number of other policy issues, including:

(1) to contain COVID-19;

(2) for relief, recovery, and growth;

(3) to build back better;

(4) of COVID-19, especially through non-pharmaceutical interventions like testing-tracing-isolation;

(5) to prevent long-term losses of human capital, especially for the poor;

(6) to help households smooth consumption and workers reintegrate as countries recover;

(7) to prevent bankruptcies and unemployment, without unduly inhibiting the efficient reallocation of workers and resources;

(8) to support relief and recovery without undermining financial stability;

(9) , especially of still-protected services sectors��finance, transport, communications��to enhance firm productivity, avert pressures to protect other sectors, and equip people to take advantage of the digital opportunities whose emergence the pandemic is accelerating;

(10) creating and to promote equitable growth;

(11) policies to encourage ; and

(12) policies to address new and old .