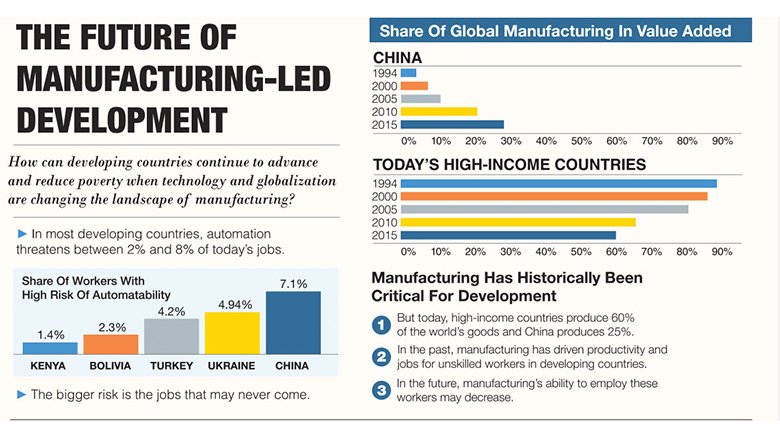

WASHINGTON, September 20, 2017 �C Throughout history, lower-income countries have relied on manufacturing, which provides jobs for unskilled workers, helps increase productivity, and drives economic growth, as a central driver of development. However, success in manufacturing and global value chains is currently concentrated in a limited number of countries. In 2015, 55% of the world��s manufactured goods were produced in high-income countries. China, the world��s largest producer, accounted for another 25%. Where does this leave other countries?

A new report from the World Bank Group��s Trade & Competitiveness Global Practice, , explains that the criteria for becoming a desirable manufacturing location are changing. Companies once influenced by the prospect of inexpensive labor costs are beginning to favor locations that can better take advantage of new technologies.

How can developing countries continue to advance and reduce poverty when technology and globalization are changing manufacturing? View full graphic>>

The increasing adoption of industrial automation, advanced robotics, smart factories, the internet of things, and 3D printing are transforming the manufacturing process. ��The use of new technologies to produce traditional manufactured goods will be disruptive in developing economies �C whether they are using the new technologies or not,�� says Mary Hallward-Driemeier, Senior Economic Advisor with the World Bank Group��s Trade & Competitiveness Global Practice and lead author of the report. ��If labor represents a smaller share of costs, more production may happen in richer countries, closer to consumers. Fewer businesses may move to lower-cost locations and local firms will face steeper competition. But it is not all bad news. There are new opportunities too �C and that part of the story needs more attention.��