DAR ES SALAAM, September 19, 2023ˇŞOver the past decade, Tanzania has made strides in broadening its tax collection efforts, and its fiscal policy has played a vital role in supporting inclusive and sustainable growth. The highlights these efforts and the country's solid macroeconomic footing, which has underpinned its recent shift to lower middle-income status. This foundation sets the stage for a robust, inclusive, and sustainable long-term growth trajectory, with a focus on advancing a more ambitious human capital development agenda. In addition to a fiscal position that remains relatively strong and stable, Tanzania stands out as one of the few economies in the region that avoided contraction in 2020. Moreover, its moderate risk of debt distress provides room for judicious use of debt financing. Nonetheless, there remains room for the enhancement in domestic revenue mobilization. This improvement can enable a more substantial allocation of public funds to bolster social services, thereby enhancing the nation's human capital outcomes and reducing poverty.

According to the just published , the countryˇŻs tax-to-GDP ratio increased from 10% in 2004/05 to 11.8% in 2022/23, with a peak of 13.3% in 2015/16. This ratio is closer to that of low-income countries (LICs), while Tanzania is already a lower-middle-income country (LMIC).

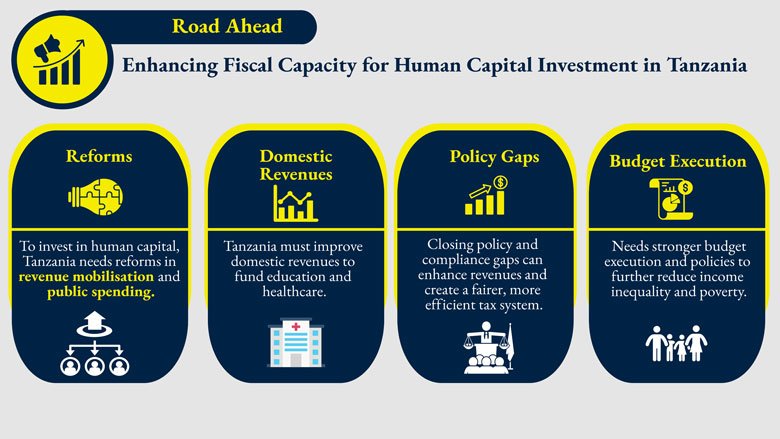

Low domestic revenue mobilization has led to low overall public expenditure. While public spending is low across all expenditure categories compared to comparable countries, the most pronounced gap is observed in social spending. To illustrate, Tanzania's public spending on education and healthcare amounts to only 3.3% and 1.2% of GDP in 2021/22, respectively. These figures fall below the average spending levels of 4.4% and 2.3% for LMICs.

ˇ°While additional resources are needed to close the service delivery gaps in both sectors, there is scope to improve the efficiency of spending within the current systems. For example, if the healthcare system were to operate at its utmost efficiency, Tanzania could enhance critical health outcomes by 11% without necessitating additional resources.,ˇ± said Nathan Belete, World Bank Country Director.

To compound the picture, budget execution rates have consistently lagged, with the execution rate for the development budget averaging 67% over the past four years through 2020/21. The execution rate for domestically financed projects rose from 60% in 2017/18 to 85% in 2020/21, but the rate for foreign-financed projects averaged just 58%.

ˇ°Low budget execution rates suggest that there are opportunities for improvement in strategic planning, budget preparation, and procurement processes,ˇ± said Emmanuel Mungunasi, World Bank Senior Economist and co-author of the Update. ˇ°Additionally, thereˇŻs need to address delays in contracting non-concessional loans as well as delays in project preparation and implementation, as these are linked to the under-disbursement of concessional funds.ˇ±

Against this background, the Update authors recommend the efficient deployment of fiscal policy to address income and wealth inequalities. Tanzania's fiscal policy is already reducing income inequality by distributing revenue and spending money on important social services. To ensure that everyone pays their fair share of taxes, the Update authors recommend improving the way income and wealth are taxed to help reinforce the social contract between citizens and the government and also benefit the overall economy.

ˇ°Because Tanzania relies chiefly on fiscal policy to achieve its growth and stabilization objectives, it must adopt a policy pathway that allows greater expenditure predictability for increased physical and human capital investments, which is critical for inclusive and sustainable economic growth over the long term,ˇ± said Jaffar Rikabi, World Bank Senior Economist, and co-author of the report.

Improved tax collection helped narrow the tax gap from 8% of GDP in 2000 to 5.6% of GDP in 2017. To close the policy and compliance gaps further and increase revenue collection for improved public spending, the report authors recommend:

- Boosting the productivity of progressive taxes: TanzaniaˇŻs direct taxes, like personal income tax and corporate income tax, are highly progressive, and VAT also appears to be moderately progressive, unlike VATs in many comparable countries. The government can benefit by rationalizing tax expenditures, lowering the VAT threshold, leveraging digital technologies, and reducing tax compliance gaps.

- Improving administration capacities: There is a need for systemic reforms to build the capacity of the revenue administration that will help to expand collection efficiently and equitably, including addressing VAT refund arrears.

- Improving budget implementation: There is a need to improve the execution of budgets at all government levels, with a particular focus on development projects and non-salary expenditures.

- Focusing on priority sectors: As domestic revenue mobilization improves and budget execution becomes efficient, there is a need to increase expenditures for social sectors (education, health, and social protection) to improve human capital outcomes and reduce inequality.

- Reducing income inequality and poverty: There is a need to strengthen the distributional impacts of fiscal policy by broadening the tax base and making more use of conditional cash transfers and support for public primary education, which have been demonstrated to be pro-poor over time.