International Comparison Program

The International Comparion Program estimates purchasing power parities (PPPs) for the world’s economies in order to provide comparable price and volume measures of GDP and its expenditure components. PPPs convert different currencies to a common currency and, in the process of conversion, equalize their purchasing power by controlling for differences in price levels between economies.

Overall, the ICP methodology has three major components. The first is the System of National Accounts (SNA) definition of final expenditures on GDP. The second is the basket of goods and services from which items are selected for pricing: the priced items should be comparable across economies and should represent an important part of each economy’s final purchases. The third component is the methodology used to compute PPPs, first within regions for the regional comparisons and then across regions for the global comparison.

Each ICP comparison has a reference year, such as 2011, 2017 or 2021. Each participating economy is required to provide the following data for the reference year: a set of national annual average prices for a selection of items chosen from a common basket of precisely defined goods and services; a detailed breakdown of the national accounts expenditures in local currency units according to a common classification; the economy’s market exchange rates; and its resident population.

Prices and expenditures are used to calculate PPPs and PPP-based expenditures. Market exchange rates and PPPs are used to calculate price level indexes. Population totals and PPP-based expenditures are used to calculate per capita expenditures. Prices and expenditures are reported by participating economies in their local currencies. Both metrics cover the whole range of final goods and services constituting GDP.

Framework and classification

National accounts expenditures are essential for the International Comparison Program (ICP). First, they are used as weights to aggregate purchasing power parities (PPPs) through the various levels of aggregation up to gross domestic product (GDP). Second, they are ultimately deflated by the PPPs and expressed as real expenditures. Neither aggregated PPPs nor real expenditures will be reliable unless the national expenditures provided by economies are comparable—that is, they are compiled using the same definitions of GDP and its component expenditures and are equally exhaustive in their measurement of economic activity. The common national accounts framework was System of National Accounts (SNA) 93 for the ICP 2011 cycle and SNA2008 for the 2017 ICP cycle onward.

The SNA defines GDP from the expenditure side as the sum of expenditures on final consumption, gross capital formation, and net exports. Final consumption is the total expenditure on the goods and services consumed by individual households or the community to satisfy their individual or collective needs. Gross capital formation is the total expenditure on gross fixed capital formation, changes in inventories, and acquisitions less disposals of valuables. Net exports are the difference between the value of goods and services exported and the value of goods and services imported.

The current ICP expenditure classification on GDP comprises six main aggregates, which are broken down into 28 expenditure categories, 63 expenditure groups, 126 expenditure classes, and 155 basic headings.

[ Back to top ]

Expenditure data compilation

Economies participating in the ICP are expected to estimate their GDP for the reference year in line with the SNA and to disaggregate this GDP estimate into the relevant expenditure components identified in the ICP expenditure classification.

At the lowest level of the classification, the expenditure components are termed basic headings. The classification breaks down the expenditure on final goods and services into 155 basic headings that comply with the functional and product classifications of SNA2008 and are the building blocks of the ICP comparison. They are the level at which expenditures are defined and estimated, items are selected for pricing, and prices are collected. Basic headings are the level at which PPPs are first calculated.

In principle, a basic heading consists of a group of similar well-defined goods or services. In practice, a basic heading is defined by the lowest level of final expenditure for which the participating economies can estimate explicit expenditures. Consequently, basic headings can cover a broader range of goods or services than is theoretically desirable.

[ Back to top ]

Expenditure data validation

National accounts data validation requires three stages: first, intra-country validation carried out by the individual participating economies; second, inter-country validation carried out at the regional level; and third, inter-regional validation carried out at the global level.

Before the national accounts expenditure data are sent to the regional offices, basic edits are carried out by the national implementing agencies. These include:

- ensuring SNA compliance, including data completeness, applicability of positive and negative values, and additivity; and

- ensuring the correct estimation of financial intermediation services indirectly measured (FISIM), net purchases abroad, and nonprofit institutions serving households (NPISHs).

Furthermore, an economic plausibility assessment, such as verifying per capita basic-heading expenditures and basic-heading shares of GDP, is also advised.

The validation edits carried out at the national level are repeated at the regional level. The aim of the regional validation is to compare the consistency of data from similar economies within a region. The regional implementing agency identifies clusters of economies based on their economic similarities. GDP per capita in previous years serves as a key indicator of the cluster to which an economy is allocated.

The global comparison of real expenditures (and their per capita equivalents) is achieved by linking regional results to form a global set of results. At the global level, the same intra-country validation processes as previously defined are followed. The intercountry validation process is also followed across economies and within and between regions.

[ Back to top ]

Further resources:

- Current ICP Classification ( (Excel) | (PDF))

- ICP 2005/2011 Classification ( (PDF) / (PDF)/ (PDF) / (PDF) | (PDF))

- National Accounts Validation Tool ( (Excel) | (Excel) )

- (Excel)

- (Excel)

- (PDF)

- Operational Guidelines and Procedures for Measuring the Real Size of the World Economy

- (PDF)

[ Back to top ]

Gross fixed capital formation: Machinery and equipment

Gross fixed capital formation: Construction and civil engineering

Economies participating in the International Comparison Program (ICP) collect prices for a selection of the goods and services that make up final consumption expenditure and gross capital formation. There are four main surveys:

- Household consumption

- Government consumption

- Machinery and equipment

- Construction and civil engineering

For each of these surveys there is a global core list (GCL) of items, prepared in consultation with regional and national implementing agencies and based on the GCL list of previous ICP cycles to maintain temporal comparability. In addition, each region develops its own list of regional items for the regional comparison, which includes region-specific items representative of the consumption pattern in the region, as well as GCL items needed for linking the regional results into a global set of results.

All prices reported are national annual average prices, in local currency, for the reference year—that is, they should be the average of the prices collected at regular intervals throughout the year. When price surveys are conducted outside the reference year, prices are retropolated or extrapolated using the consumer price index (CPI).

[ Back to top ]

Household consumption

The household consumption survey covers the largest expenditure share, accounting for more than 60 percent of gross domestic product (GDP) in the majority of economies. It includes a wide assortment of goods and services purchased by households for individual consumption. This survey also includes two additional surveys that are treated separately due to different data requirements; these are the private education and housing surveys.

Main household consumption survey collects prices for a wide range of goods and services for household consumption such as food, beverages, tobacco, clothing, footwear, utilities, furniture, household appliances, pharmaceuticals, private health care services, motor vehicles, transportation services, electronic equipment, communication services, catering services, accommodation services, recreational activities, personal hygiene, and other goods and services. For this survey, each economy classifies the items priced as important or less important for the consumption patterns of its inhabitants.

Private education survey collects annual tuition prices for private education institutions at the primary, secondary, and tertiary levels as well as other education services, such as foreign language and private tutoring.

Housing survey collects annual rental prices or dwelling stock data for housing services. Rental prices are collected for similar dwelling types in each economy. This approach has been found to work well in economies in which the dwellings actually rented are representative of the stock of dwellings as a whole and where statistical agencies collect information on rents paid for the different kinds of dwellings that are rented in most parts of the economy. Dwelling stock data is collected for both the quantity and quality of the dwelling stock.

[ Back to top ]

Government consumption

Government consumption survey compiles administrative or survey data on the compensation of public employees in a variety of collective services, public health services, and public education services. The selection of government occupations represents the various education and skills levels that are commonly found among employees working in these three government sectors.

Collected data reflect the basic salary or wage, allowances and cash payments over and above the basic salary or wage, income in kind, and the employer’s actual and imputed social security contribution. The sources of the data reported are the administrative government pay scales for each of the selected occupations or dedicated surveys on the compensation of government employees. The GCL defines these occupations using job descriptions taken from the International Labour Organization’s (ILO) .

[ Back to top ]

Gross fixed capital formation: Machinery and equipment

Machinery and equipment survey collects on a list of industrial, transportation, and electronic items commonly used in a variety of industries for the production of goods and services. The GCL includes one item identified by brand and model and another generic item with the exact same characteristics, but not identified by brand and model. For consistency with national accounts, prices for equipment goods that are consistent with the valuation of those goods as fixed capital assets in the national accounts are required. Thus the prices must include the import duties and other taxes actually paid by the purchaser, the costs of transporting the asset to the place where it will be used, and any charges for installing the asset so that it will be ready for use in production. Deducted from the price are the discounts generally available to most purchasers.

[ Back to top ]

Gross fixed capital formation: Construction and civil engineering

Construction and civil engineering survey collects prices for inputs to construction work, including materials, equipment hire, and labor. The prices provided are those paid by construction contractors to their suppliers. For materials, these are typically the prices paid, after discounts, to manufacturers or intermediaries (agents or merchants), including all nonrecoverable taxes and excluding all recoverable taxes such as a value added tax. For equipment, prices are the rental charges paid to hire companies or internal hire rates. For labor, these reflect the cost to the contractor of employing workers. In addition, resource weights for each input component (materials, equipment hire, labor) for typical residential, nonresidential, and civil engineering projects are collected.

[ Back to top ]

Price data validation

Validation procedures are an iterative process carried out at the national, regional, and global levels to ensure data quality and comparability across all participating economies.

The validation process comprises three distinct stages. The first is the intra-country or national validation stage, during which the prices collected by a single economy are edited and verified. The second is the inter-country or regional validation stage, during which the prices collected by all economies participating in a regional comparison are edited and verified. The third is the inter-regional, or global, validation stage, during which the prices that have been collected for global core items from the GCL and have already been edited and verified within regions during the intercountry validation are edited and verified across all economies and all regions.

This process is repeated over several rounds, since changes and revisions to price data from one economy impact the PPPs calculated for all other economies. Once errors are found and corrected, overall results need to be recalculated and a new validation round begins. The new results, once cleared of major errors, may reveal mistakes that were not previously detected. This process repeats itself until the final price data are deemed reliable.

It should be stressed that validation procedures are complementary to good survey practices. Data quality depends to a large extent on the design and management of each price survey. Price collections must be planned carefully, carried out efficiently, and supervised properly. Item specifications must be sufficiently detailed to enable price collectors to identify items unambiguously in the outlets they visit. Any difficulties arising with each price survey should be documented and reflected in the design and conduct of future surveys.

[ Back to top ]

Further resources:

[ Back to top ]

Imputing PPPs for non-benchmark economies

Interpolating time series PPPs

Price relatives are first computed for individual items within each basic heading for each pair of economies being compared. Basic headings are the lowest aggregation level in the ICP expenditure classification for which explicit national accounts expenditure weights can be estimated. Elementary PPPs are then calculated for each basic heading based on these price relatives. They are subsequently aggregated to calculate PPPs for each classification aggregate.

Suppose three economies—A, B, and C—price two kinds of rice under the rice basic heading. For each kind of rice, there are three price relatives: PB/PA, PC/PA, and PC/PB. The basic-heading PPP for each pair of economies can be computed directly by taking the geometric mean of the price relatives between them for the two kinds of rice. This is a bilateral comparison. The PPP between economies B and A can be computed indirectly: PPP C/A × PPP B/C = PPP B/A. The use of both direct and indirect PPPs is a multilateral comparison. This means that the PPPs between any two economies are affected by their respective PPPs with other economies in the comparison. As a result, a change in the mix of economies included in the comparison will also change the PPPs between any two economies.

Different methods can be used to compute multilateral PPPs. The choice of method is based on two basic properties: transitivity and base country invariance. PPPs are transitive when the PPP between any two economies is the same whether it is computed directly or indirectly through a third economy. PPPs are base country invariant if the PPP between any two economies is the same regardless of the choice of the base economy.

Another property underlying the computational steps to obtain ICP PPPs is that economies are treated equally regardless of the size of their gross domestic product (GDP). However, this property does not satisfy the additivity requirement. Additivity occurs when the sum of the real expenditures of the basic headings constituting an aggregate equals the real expenditures based on the PPPs for the aggregate. Additive methods have the disadvantage of giving more weight to the relative prices of the larger, more developed economies. As a result, the real expenditures of poor economies become artificially larger and move closer to the real expenditures of rich economies. This is known as the Gerschenkron effect. For the uses of ICP PPPs, such as for poverty analysis, non-additive methods that avoid the Gerschenkron effect are preferred.

Fixity is yet another concept that determines the methods used. The fixity concept means that the relative volume—the ratio of real expenditures—between any pair of economies in a region remains the same after the regional results have been combined into a set of global results including all economies.

[ Back to top ]

Elementary PPP calculation

The PPP estimation process begins with the participating economies collecting prices for items chosen from a common list of precisely defined items. These common lists include both regional items, priced in a specific region, as well as global items, priced in all ICP regions. These two sets of prices cover the whole range of final goods and services included in GDP: household consumption expenditures, government consumption expenditures, and gross capital formation expenditures. In the current ICP methodology, basic-heading PPPs are first estimated at the regional level and subsequently linked at the global level through the global linking procedure outlined in the following sub-section.

Two basic methods are used in the ICP to calculate basic-heading PPPs. The first approach is based on the Jevons index made transitive by the Gini-Éltető-Köves-Szulc (GEKS) method, which transforms bilateral PPPs into multilateral PPPs. The other method uses a regression model known as the country product dummy (CPD) method, which directly estimates PPPs that are transitive and base-country invariant in one step. The results obtained by both methods are the same if every economy prices every item. Both methods can be modified to include weighting at the item level.

[ Back to top ]

Reference PPPs

For some basic headings, expenditure data exist, but price collection is considered too expensive or time-consuming or the price data are unreliable. For these basic headings, reference PPPs are used, and they can be categorized as follows:

- Price-based reference PPPs, specific or neutral

- Market exchange rate reference PPPs.

Price-based reference PPPs form the majority of all reference PPPs used. They are based on the PPPs of other basic headings for which prices were collected. These PPPs are referred to as specific reference PPPs. They may refer to PPPs for a single basic heading or an average of the PPPs for several basic headings.

Market exchange rate reference PPPs are used for the following four basic headings: net purchases abroad, acquisitions less disposals of valuables, exports of goods and services, and imports of goods and services.

- (PDF)

[ Back to top ]

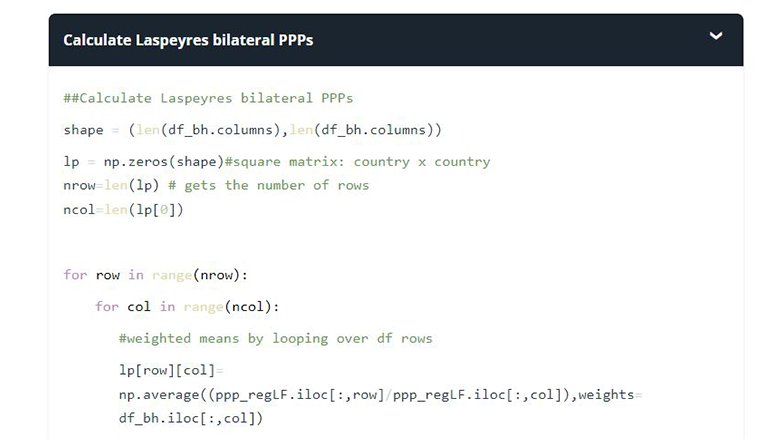

PPP aggregation

Once PPPs are computed for each basic heading for all participating economies within a region, they are used as inputs for the higher levels of aggregation using the GEKS method. Basic heading PPPs are first weighted using economy A’s weights (Laspeyres index), and then weighted again using economy B’s weights (Paasche index). Each index provides a weighted average of the PPP between economies A and B. To maintain symmetry, the geometric mean is taken of the two aggregated PPPs for every pair of economies in the comparison. The result is a Fisher index. For each pair of economies, the multilateral GEKS PPP is the geometric mean of the direct and indirect Fisher indexes.

[ Back to top ]

PPP linking

At the global level, regional PPPs are linked to form a global set of PPPs and measures of price and volume relatives. In order to link the regional basic-heading PPPs for each participating economy, interregional linking factors are calculated based on the prices of global items collected in all ICP regions.

The GEKS aggregation method, with further redistribution of regional volumes in accordance with an economy’s regional volume shares (known as the country aggregation with redistribution [CAR] procedure), is used to obtain real expenditures (hereafter referred to as volumes) and aggregated PPPs with regional fixity. All economies in the standard ICP regions participated simultaneously and equally in the global aggregation using the GEKS method.

[ Back to top ]

Imputing PPPs for non-participating economies

Although non-participating economies account for a small share of the world economy and world population, it is important that they be included in any comprehensive measurement of the size of the world economy or of global poverty.

The method used for imputing PPPs for nonparticipating economies uses three regression models, one based on the price level index (PLI) for GDP, one based on the PLI for individual consumption expenditure by households, including non-profit institutions serving households (NPISHs), and the third, introduced for the first time in the ICP 2021 cycle, based on the PLI for actual individual consumption (AIC). The three regressions are estimated jointly using the “seemingly unrelated regression” method. The required explanatory variables are the following: GDP per capita in US dollars based on market exchange rates; imports as a share of GDP; exports as a share of GDP; and the age dependency ratio. Dummy variables are required for the Sub-Saharan African economies, the Eurostat-OECD PPP Programme participants, island economies, and landlocked economies. Interaction terms of GDP per capita in US dollars based on market exchange rates and the dummy variables are also required.

[ Back to top ]

Interpolating time series PPPs

For the years between reference years, currently between 2017 and 2021, PPPs are calculated based on an approach in which basic heading PPPs are first interpolated between the reference years and subsequently aggregated using the standard GEKS method. In addition, regional PPPs between the reference years, where available, are incorporated using the CAR procedure. The resulting time series PPPs uphold the same properties of base-country invariance and fixity as the PPPs from reference year comparisons.

The data required to construct time series PPPs included global PPPs for the two reference years; regional PPPs between the reference years, where available; national accounts deflators and consumer price indexes; national accounts expenditures at current prices in local currency units; market exchange rates; and population.

[ Back to top ]

Further resources:

[ Back to top ]

Analytical headings

Analytical headings, also known as non-hierarchical headings, exist independently of the ICP Classification. They are published for ICP benchmark years to facilitate data analysis, support technical interpretation, and inform policymaking. These headings offer insights into aggregate levels not covered by the ICP Classification. The computation of these headings involves the summation of relevant ICP Classification headings, as noted below.

9020000 ACTUAL INDIVIDUAL CONSUMPTION

The total value of the individual consumption expenditures of households, nonprofit institutions serving households (NPISHs), and government at purchasers’ prices.

9060000 ACTUAL HOUSING, WATER, ELECTRICITY, GAS AND OTHER FUELS

Household expenditure on actual and imputed rentals for housing; maintenance and repair of the dwelling; water supply and services related to the dwelling; and electricity, gas, and other fuels plus expenditure by nonprofit institutions serving households (NPISHs) on housing plus general government expenditure on housing services provided to individuals.

9080000 ACTUAL HEALTH

Household expenditure on pharmaceuticals; medical products, appliances, and equipment; outpatient services; and hospital services plus expenditure of nonprofit institutions serving households (NPISHs) on health plus general government expenditure on health benefits and reimbursements, and the production of health services.

9100000 HOUSEHOLDS AND NPISHS FINAL CONSUMPTION EXPENDITURE

The total value of actual and imputed final consumption expenditures incurred by households and NPISHs on individual goods and services. It also includes expenditures on individual goods and services sold at prices that are not economically significant.

9110000 ACTUAL RECREATION AND CULTURE

Household expenditure on audiovisual, photographic, and information processing equipment; other major durables for recreation and culture; other recreational items and equipment; gardens and pets; recreational and cultural services; newspapers, books, and stationery; and package holidays plus expenditure by nonprofit institutions serving households (NPISHs) on recreation and culture plus general government expenditure on recreation and culture.

9120000 ACTUAL EDUCATION

Household expenditure on pre-primary, primary, secondary, postsecondary, and tertiary education plus expenditure of nonprofit institutions serving households (NPISHs) on education plus general government expenditure on education benefits and reimbursements and the production of education services.

9140000 ACTUAL MISCELLANEOUS GOODS AND SERVICES

Household expenditure on personal care, personal effects, social protection, insurance, and financial and other services plus expenditure by nonprofit institutions serving households (NPISHs) on social protection and other services plus general government expenditure on social protection.

9250000 DOMESTIC ABSORPTION

Actual individual consumption at purchasers’ prices plus collective consumption expenditure by government at purchasers’ prices plus gross capital formation at purchasers’ prices.

9260000 INDIVIDUAL CONSUMPTION EXPENDITURE BY HOUSEHOLDS WITHOUT HOUSING

The total value of actual and imputed final consumption expenditures incurred by households and NPISHs on individual goods and services, without housing related expenditures. It also includes expenditures on individual goods and services sold at prices that are not economically significant.

9270000 GENERAL GOVERNMENT FINAL CONSUMPTION EXPENDITURE

The total value of actual and imputed final consumption expenditures incurred by government on individual goods and services and final consumption expenditure of government on collective goods and services.

9280000 TOTAL CONSUMPTION

The total value of actual and imputed final consumption expenditures incurred by households, NPISHs, and government on individual goods and services and final consumption expenditure of government on collective goods and services.